Content

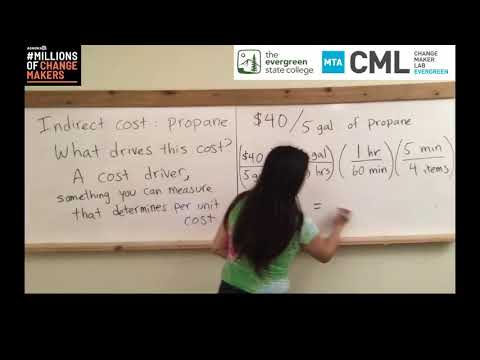

To capture accrued income with cash basis accounting, you must debit it on the balance sheet under current assets as an adjusting journal entry. The cash flow from operations part of the statement adjusts net income for the change https://kelleysbookkeeping.com/ in accounts receivable and accrued expenses. If a company is doing all or mostly credit sales, having a hard time collecting, and pushing out payments to its suppliers, it could be cash flow negative while net income positive.

The key difference between accrued and deferred revenue is the timing of recognition. Accrued revenue is the revenue that has been earned but not yet received, while deferred revenue is the revenue that has been received but not yet earned. In most countries, companies are required to pay taxes on their revenue, regardless of whether or not they have received the payment. By recognizing accrued revenue, companies can accurately calculate their tax liability and avoid penalties or fines for underpayment.

How is accrued revenue tracked and accounted for in the financial statements?

It states that revenues and expenses should be recorded on financial statements in the period when they are earned or incurred. This means a business can record revenue when it hasn’t yet collected cash and can record expenses even if it hasn’t paid them. SaaS businesses sell pre-paid subscriptions with services that are rendered over time and hence require the use of the accrual basis of accounting. Revenue recognition in SaaS is done when the service is rendered and the revenue is ‘earned’.

It can also assist in monitoring the firm’s profitability and identifying possible difficulties ahead of time. Assume that firm JTP agrees with client Q to provide 24 pieces of machinery annually. Because this is a long-term project, JTP can opt to identify each machine or group of machines delivered as a milestone, for which they will recognize service revenue upon completion. Instead of waiting until the contract is completed to recognize the real money, it should recognize a portion each month as services are provided.

Business

Here are some examples of accrued revenue to show you how to apply your knowledge in real-life business scenarios. Depending on the nature of your business or the type of clients you deal with, the exchange may not be immediate. This means you’ll perform the service or deliver the goods and wait for payment at a later date. Pied Piper IT Services agrees to build a flight navigation software for XYZ airlines in 12 months for a sum of $120,000. According to the contract, Pied Piper is expected to deliver the first milestone of the software in 6 months which is valued at $60,000.

This revenue will be converted to accounts receivable during the renewal in the next quarter. For example, a construction company will work on one project for many months. It needs to recognize a portion of the revenue for the contract in each month as services are rendered, rather than waiting until the end of the contract to recognize the full revenue. After recording the accrued revenue, invoice the customer for the service or product provided. It’s crucial to understand the difference between accrued and deferred revenue and how to factor them into our accounting. While it is not the only indicator of your company’s financial health, it is the raw material from which you make profits.

What Is Accrued Revenue?

Because sales are only recognized when bills are issued, not employing accrued revenue in SaaS would result in revenue recognition at longer intervals. Businesses must handle accrued revenue according to the accrual accounting principle, Accrued Revenues one of the fundamental principles of accounting. This principle states that revenues and expenses should be recognized in the financial statements that correspond to when they are earned, regardless of when payment is received.

- This type of revenue occurs when a company performs a service or delivers a product before it bills the customer.

- Properly understanding both accrued and deferred revenue is critical to properly understanding your business.

- The accrual method is the most common method used in accounting to record transactions.

- In accounting terms, it is considered to be an asset until the company invoices the customer and receives payment.

- This can happen if goods or services have been delivered, but invoices have not been sent out.

- When he draws up his Trial Balance on 31 December 2019, it may not show any record of the interest earned by that date.

Accrued expenses differ from accrued revenue as these are the expenses the business owes. The business essentially records its bills owed, but has not yet made the payment. While accrued revenue is the money expected to eventually flow into the business, the accrued expenses refer to the money that is expected to flow out of the business. These are typically rated on a consumption basis, so the invoice for the utility can’t be issued until after the service period, often requiring payment at least a full month later.

Do you already work with a financial advisor?

So, whether interest payments occur month by month or after paying off the principal, lenders receive their money down the line. Accrued revenue is most common in B2B industries where clients receive invoices after receiving a service. Whether you work in construction or SaaS, these invoices can take months to process.

- Deferred revenue is revenue that a company has received but has not yet earned.

- Also, not using accrued revenue tends to result in much lumpier revenue and profit recognition, since revenues would only be recorded at the longer intervals when invoices are issued.

- When comparing accrued revenue vs accounts receivable, it is important to understand that both may be used interchangeably.

- Without using accrued revenue, revenues, and profit would be reported in a lumpy fashion, giving a murky and not useful impression of the business’s true value.

- On the other hand, if a business has made investments, it may earn interest revenue, which can contribute to its accrued revenue.

- Accrued expenses differ from accrued revenue as these are the expenses the business owes.